philadelphia property tax rate 2019

Unsure Of The Value Of Your Property. States with flat rate individual income tax.

Maintenance Technician Resume Example Template Vibes Manager Resume Resume Examples Job Resume Examples

Tobacco and Tobacco-Related Products Tax.

. Get a property tax abatement. Connect To The People Places In Your Neighborhood Beyond. Statements of tax policy.

You operate your business from your Philadelphia residence. The 2023 preliminary values. Pay delinquent tax balances.

The average mortgage rate went from 454 in 2018 to 394 in 2019. Get a civic design review. See Property Records Deeds Owner Info Much More.

Must contain at least 4 different symbols. Get approval for work to a historic property. See Results in Minutes.

In economics a recession is a business cycle contraction when there is a general decline in economic activity. 2015 tax forms. For a 400000 home in the state the owners can expect to pay about 6711 per year in property taxes.

Section 505a and Section 324 describe the proration to property tax reduction allocations and Sterling Act Tax credits that occur when the amount available for distribution is less than 750 million. Philadelphia City Planning Commission plan reviews. ASCII characters only characters found on a standard US keyboard.

Get a property tax abatement. Get a civic design review. The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City.

The average property tax rate in the Hawkeye State is the 12th-highest in the nation. The following eight states have a flat rate individual income tax as of 2016. Occupier PR 1 713 852 3420.

From healthy diet plans to helpful weight loss tools here youll find WebMDs latest diet news and information. Resolve judgements liens and debts. You your tenants or your sub-tenants use your Philadelphia property for.

For the 2022 tax year the rates are. Colorado 463 2019 Illinois 495 July 2017 Indiana 323 Counties may impose an additional income tax. Find All The Record Information You Need Here.

Make an appointment for City taxes or a water bill in person. 6 to 30 characters long. 379 IMPORTANT UPDATE.

The City of Philadelphia recently launched an online calculator to help residents estimate their 2023 property tax bills. Tax forms instructions. They successfully lobbied to restrict the property and citizenship rights of Japanese immigrants.

Markets PR 1 312 228 3950. Get approval for work to a historic property. Get approval for work to a historic property.

37-2019 Building Cleaning Workers All Other. Philadelphia City Planning Commission plan reviews. How to file and pay City taxes.

Public opinion of Philadelphias property tax remains low with residents scoring it as one of the most unfair levies in a poll conducted by Pew Charitable Trusts. Get a civic design review. See Taxation in Indiana.

The Real Estate Tax estimator is available on the propertyphilagov website. 38712 for Philadelphia residents. The following tables are sortable.

Ad Enter Any Address Receive a Comprehensive Property Report. The hotel operator is responsible for. The Citys Hotel Tax rate is 85 of the total amount paid by the guest.

Eligible applicants pay Wage Tax at a lower rate. 06317 City 07681 School District 13998 Total. Philadelphia City Planning Commission plan reviews.

Get a civic design review. Official site for Holiday Inn Holiday Inn Express Crowne Plaza Hotel Indigo InterContinental Staybridge Suites Candlewood Suites. Due to the time pressure and strict limits on how much they could take to the camps few were able to preserve.

Americas Corporate Communications 1 312 228 2112. Get approval for work to a historic property. Resolve judgements liens and debts.

For more information about rates. The tax rate is based on the sale price or assessed value of the property plus any assumed debt. Electronic funds transfer EFT Modernized e-Filing MeF for City taxes.

1 reduce the real estate tax rate for all properties and 2 reduce the earned income tax rate levied pursuant to section 321. Thats a savings of 520 a month or 6240 a year when compared with the 8 longterm average In 2019 it was. Search Any Address 2.

Philadelphia City Planning Commission plan reviews. On gross receipts and 620 on taxable net income. This guidance gives some flexibility for schools to look at the transmission rate in their area and the unique variables of their.

38809 for Philadelphia residents. Interest penalties and fees. Sales Use.

Get a civic design review. Get a civic design review. 11-9140 Property Real Estate and Community Association Managers.

Appeal a property assessment. 121 of the assessed value of the property with a 2000 annual tax exemption. 13-2080 Tax Examiners Collectors and Preparers and Revenue Agents.

37-2020 Pest Control Workers. By the time the Act was passed the IRS had already destroyed most of the detainees 193942 tax records. Appeal a property assessment.

Philadelphia City Planning Commission plan reviews. Get approval for work to a historic property. For Tax Year 2019.

From now on. Massachusetts 51 2016 most types of income. Full instructions along with a schedule of eligible income amounts.

Recessions generally occur when there is a widespread drop in spending an adverse demand shockThis may be triggered by various events such as a financial crisis an external trade shock an adverse supply shock the bursting of an economic bubble or a large. Investor PR Capital Markets Hotels Property Management Valuation Advisory Agency Leasing 1 617 848 1572. State Effective Tax Rate.

Interest and penalty is due on any unpaid taxes at the rate specified by Philadelphia Code 19-509. The report states that for a family earning about 50000 in 2019 only three peer cities Baltimore Chicago and Detroit would tax a higher share of their income than. For Tax Year 2018.

States with the lowest property tax rate are ranked lowest whereas states with the highest rates are ranked highest. It was launched soon after the Office of Property Assessment OPA released new assessments for over 580000 Philly properties. Get approval for work to a historic property.

Philadelphia City Planning Commission plan reviews. Best Price Guarantee the worlds largest hotel loyalty program. 2019 tax forms.

2019 Property Taxes Paid as a Percentage of Owner-Occupied Housing Value. 11-9141 Property Real Estate and.

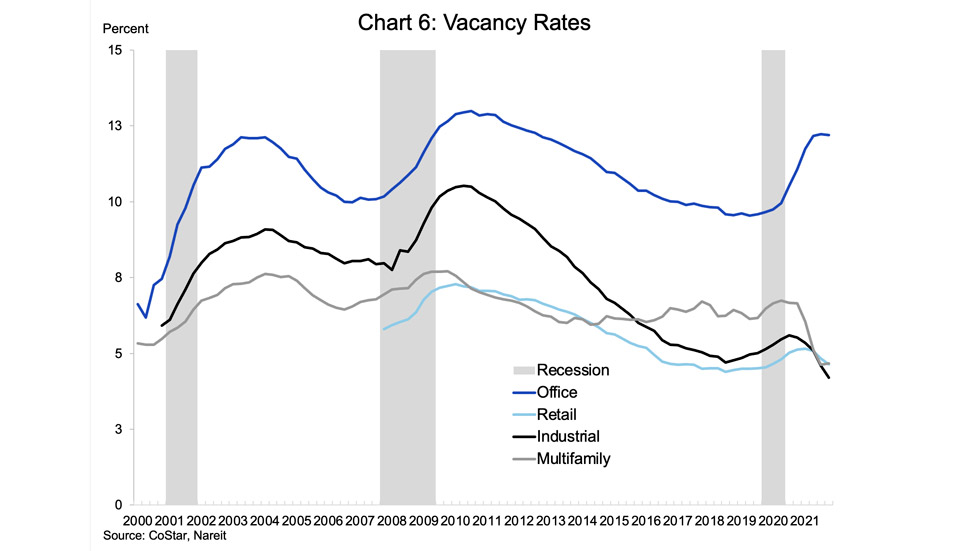

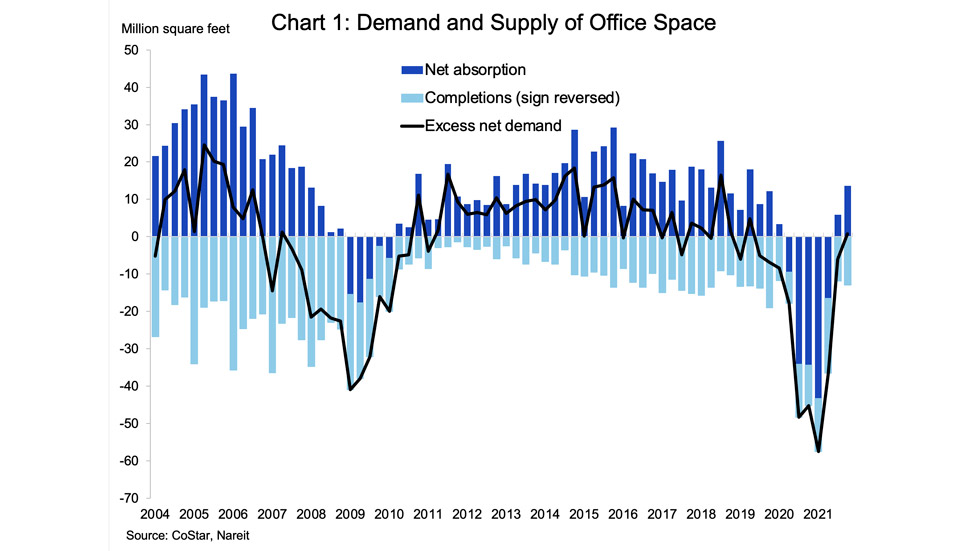

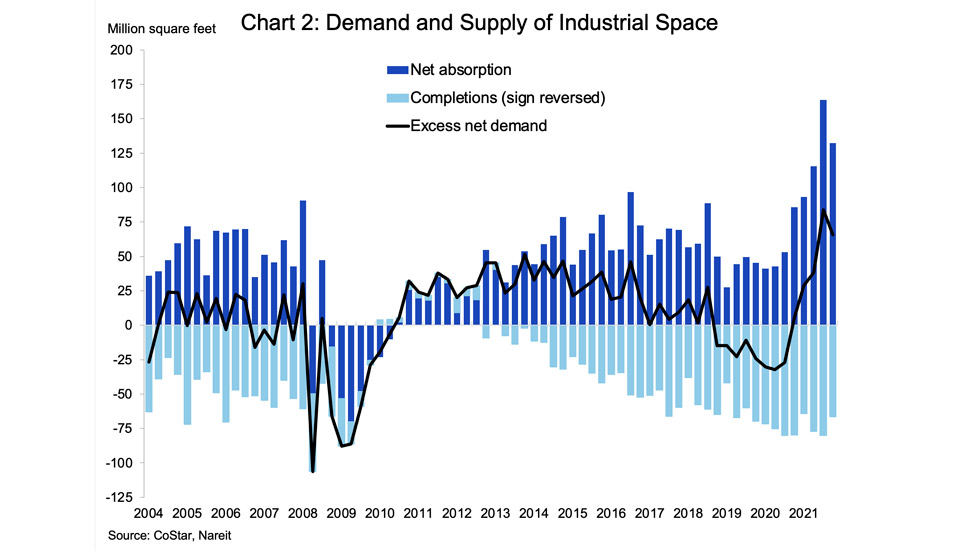

Commercial Real Estate Shows Across The Board Improvement In 2021 Q4 Nareit

Us Labor Force Surge Could Ease Pressure On The Fed For Big Rate Hike Bnn Bloomberg

U S Foreclosure Activity In October 2019 Climbs Upward From Previous Month Attom

Commercial Real Estate Shows Across The Board Improvement In 2021 Q4 Nareit

Come Out On 03 13 2019 To The First Time Home Buyer Seminar At 6 30pm Learn About Conventiona First Time Home Buyers Mortgage Tips Private Mortgage Insurance

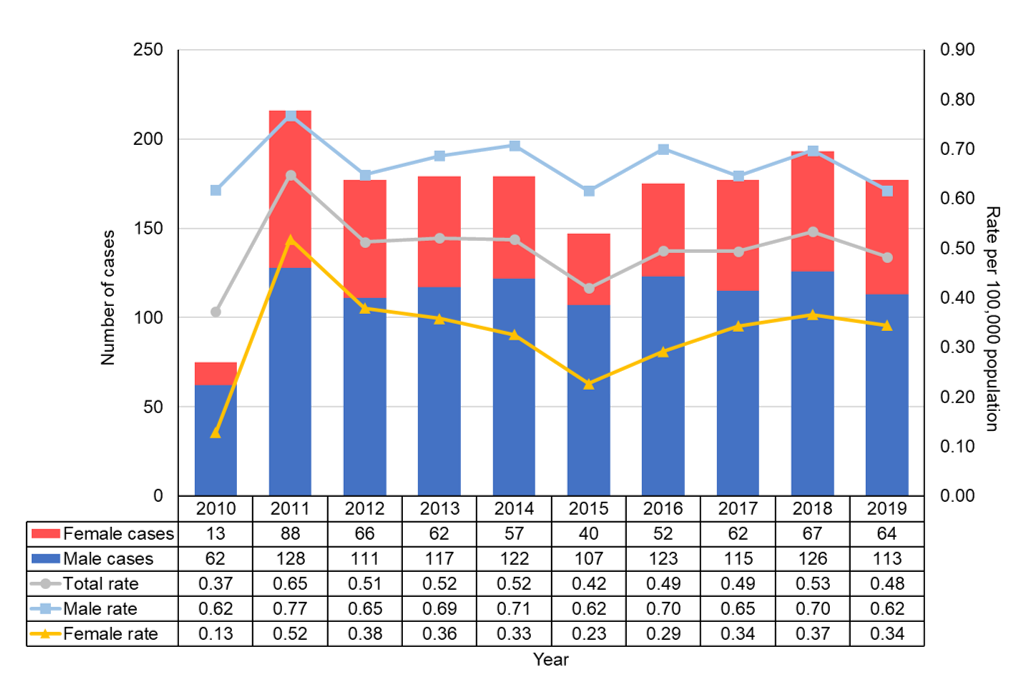

Report On Hepatitis B And C Surveillance In Canada 2019 Canada Ca

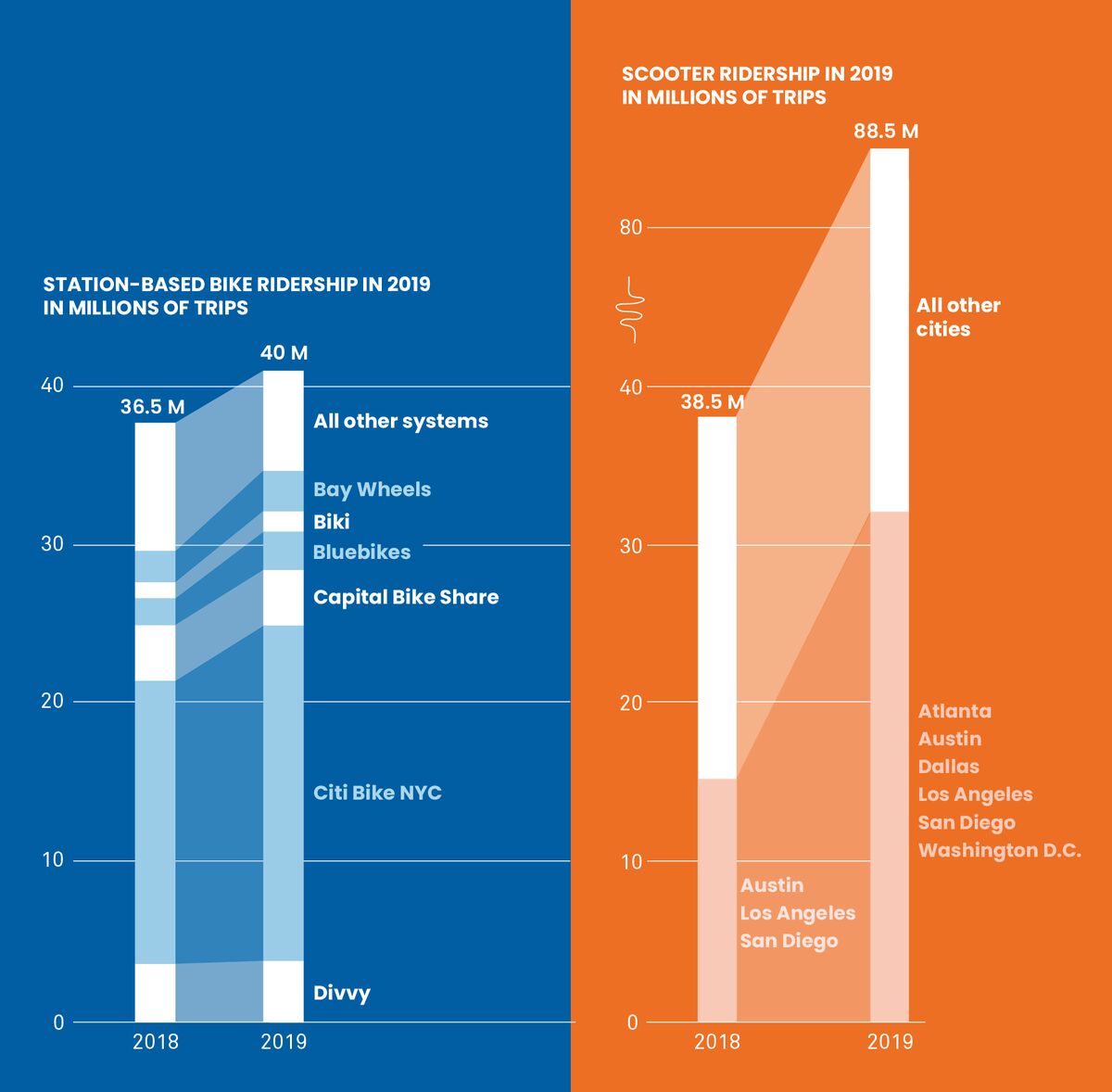

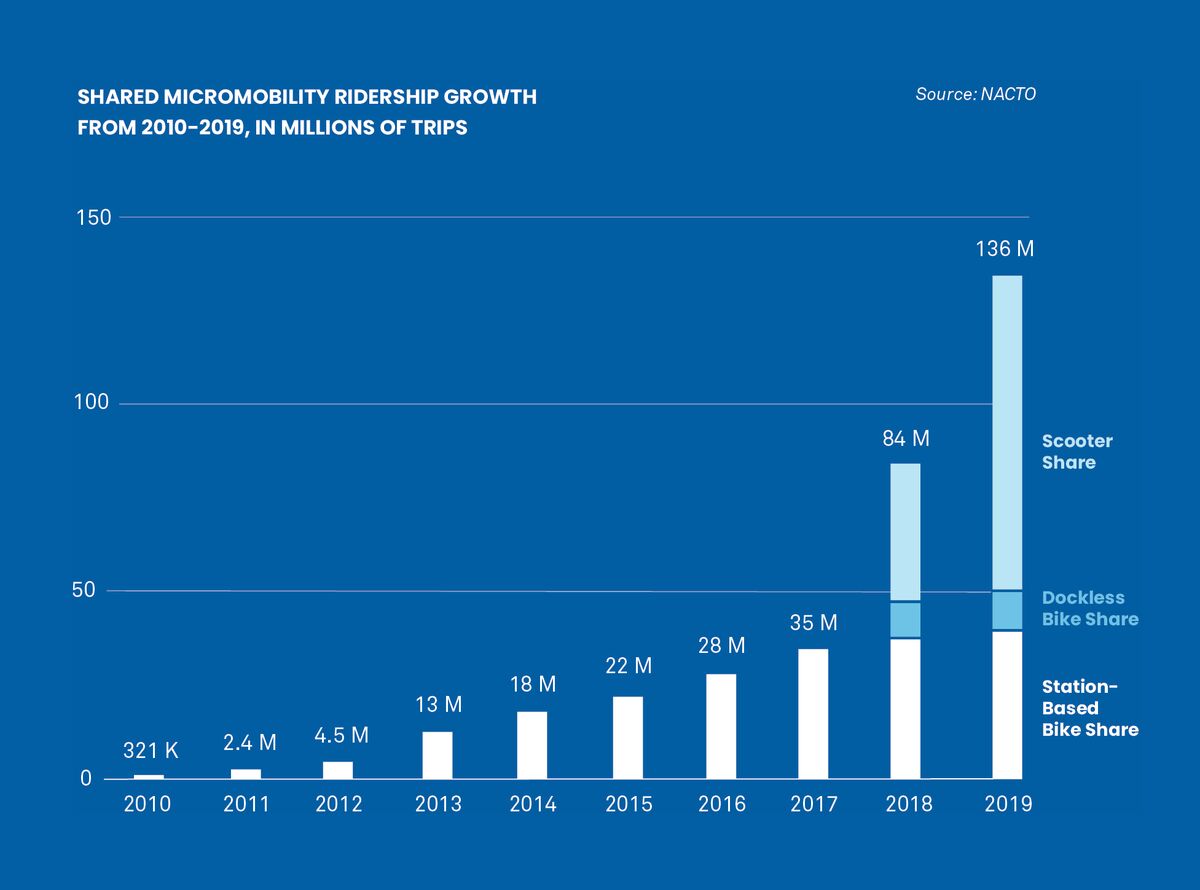

How Big Was 2019 S Scooter Boom And What S Next Bloomberg

Report On Hepatitis B And C Surveillance In Canada 2019 Canada Ca

U S Home Sellers Realized Average Price Gain Of 57 500 In First Quarter Of 2019 Down Slightly From Last Quarter Attom

Commercial Real Estate Shows Across The Board Improvement In 2021 Q4 Nareit

Default Transition And Recovery 2019 Annual Global Corporate Default And Rating Transition Study S P Global Ratings

Queenanneswarbefore New France Wikipedia North America Map Map Biloxi

Global Regional And National Sex Specific Burden And Control Of The Hiv Epidemic 1990 2019 For 204 Countries And Territories The Global Burden Of Diseases Study 2019 The Lancet Hiv

How Big Was 2019 S Scooter Boom And What S Next Bloomberg

Default Transition And Recovery 2019 Annual Global Corporate Default And Rating Transition Study S P Global Ratings

Apartment Building Permits Soar To 4 Year High Amid Rental Boom Building Permits Apartment Building Building

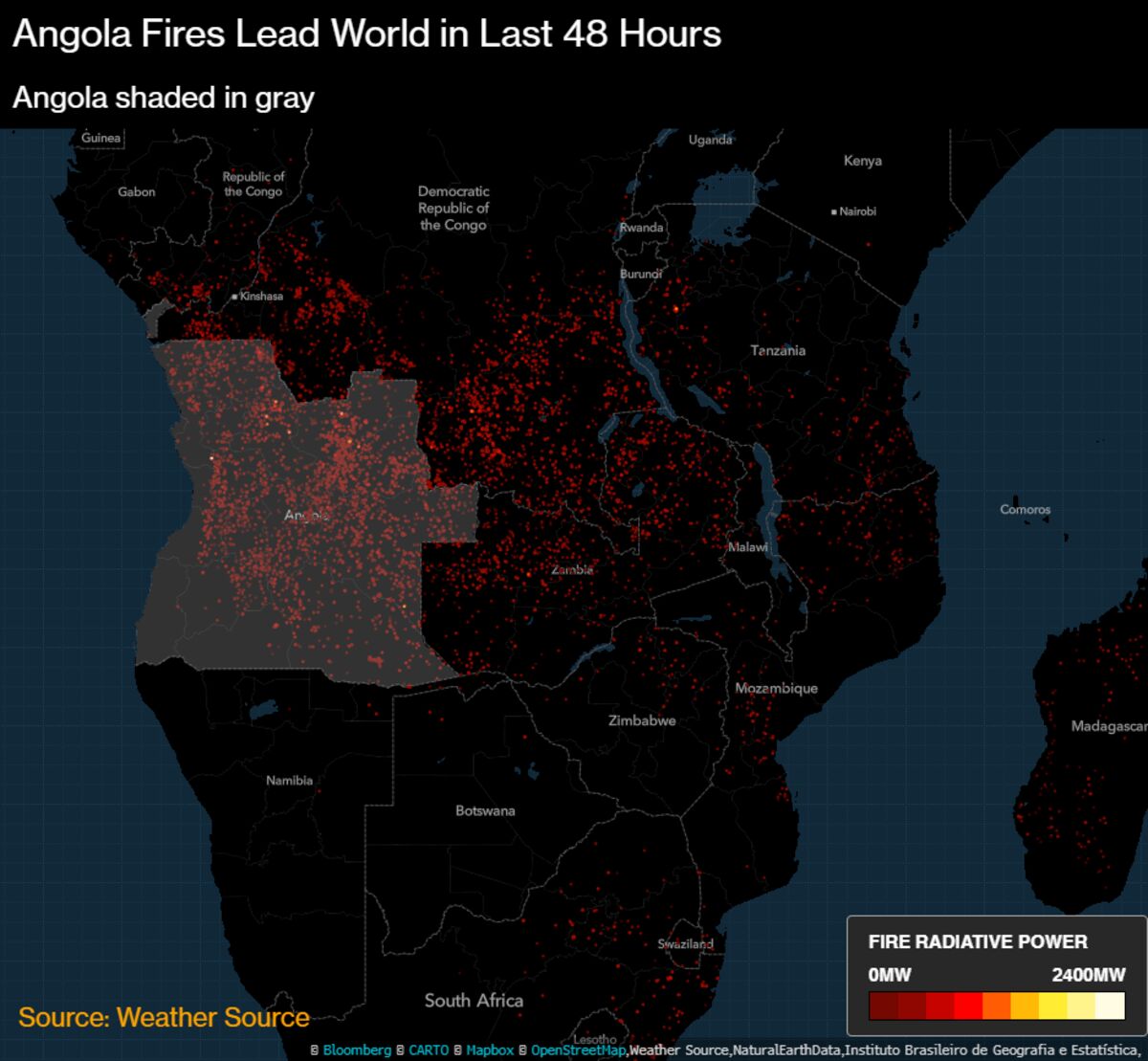

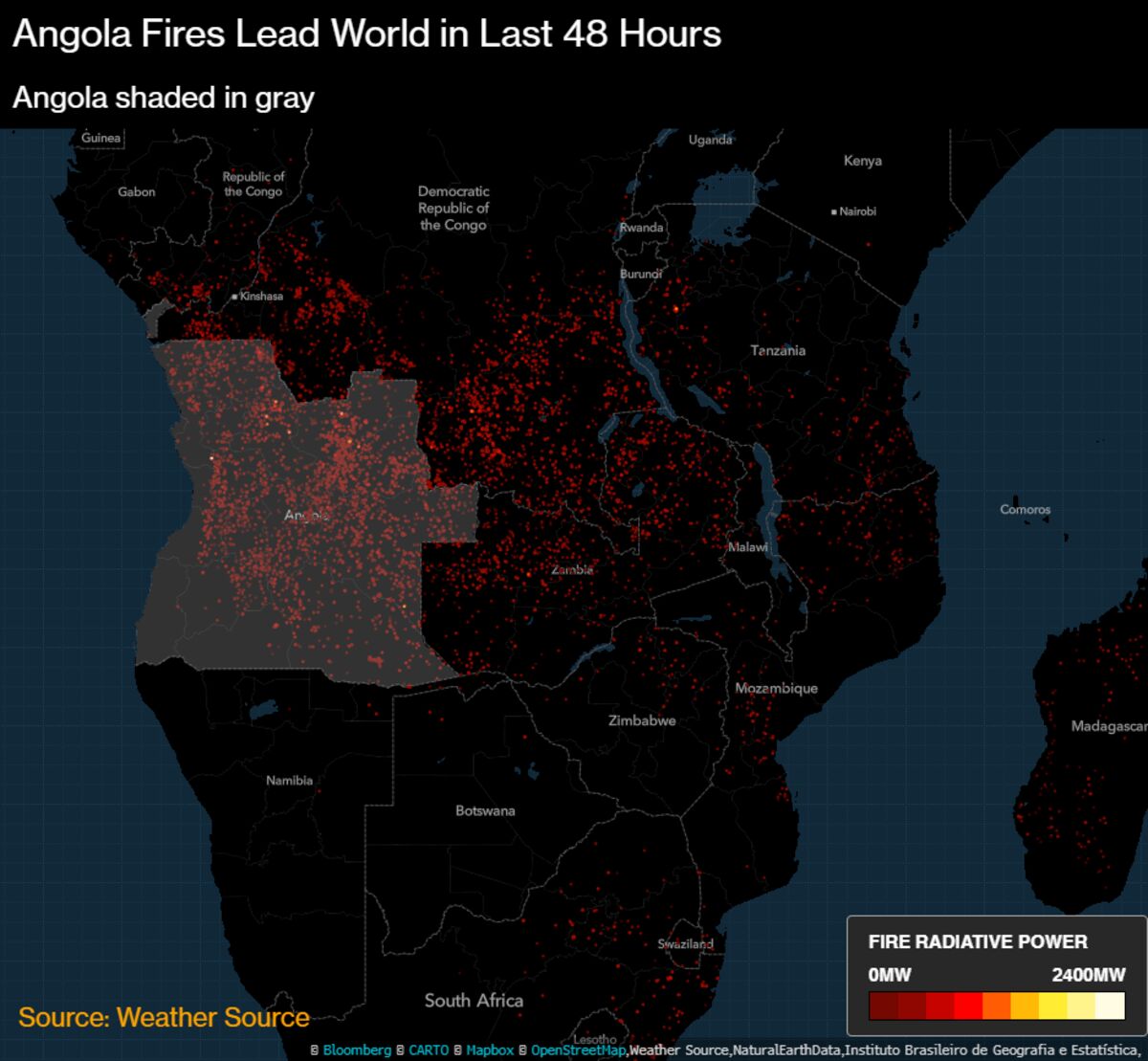

More Fires Now Burning In Angola Congo Than Amazon Maps Bloomberg

City Releases Property Tax Calculator To Assist Homeowners Department Of Revenue City Of Philadelphia